This article first appeared in NACS at Convenience.org

Current State of Affairs

In August of 1973, IBM released one of the world’s first electronic cash registers, which set a new standard for merchants.1 For over 40 years, the point-of-sale machine (POS) has dominated retail. However today, we have evidence to support that retail commerce is shifting to mobile. This article explores the evidence and provides for what we believe is a compelling case for the future of mobile commerce.

The Evidence

6 years ago in 2012, a consumer would jump in a taxi and at the end of the ride, swiped a credit card through a small POS device in the back of the car. What happens today? The consumer pushes a button on a smartphone and an Uber shows up. When the ride is over, they get out. That’s it. What happened to the POS?

3 years ago in 2015, a consumer would pay for coffee by handing a credit card to a cashier at a Dunkin’ Donuts store. Today, they order on a smartphone before arriving at the store. Then they walk in, grab their stuff and go. What happened to the interaction between the cashier, the POS, and the consumer in that transaction?

The POS is now in the pocket of the consumer. Welcome to the future. And to the past.

This is Not New

In China, Alipay and WeChat are king. WeChat is a mobile-first business that does two main things: 1. Provides consumers with an iOS and Android app that allows them to pay just about any merchant with a mobile wallet, and 2. Provides merchants the ability to sell their goods and services and push promotions to consumers through the mobile app. WeChat has become so ubiquitous in China that attempting to pay a restaurant tab or a dry cleaner with cash or a physical plastic credit card, will earn you a puzzled look from the merchant.

To put this in perspective, 400 million people in China pay for everyday goods and services with their smartphones.2 That’s more than the population of the United States.

In China, there is no need for certain retailers to purchase conventional POS systems. Transactions between consumers and merchants happen digitally, through mobile and the cloud. Physical currency and plastic credit cards have been relegated to museum exhibits.

Consumer Spending Drives Technology Adoption

Consumer spending is closely tied to the adoption of payment tender technologies by merchants. Surging demand from the consumer accelerates growth within existing merchant categories and creates new categories of merchants. If we look at consumer spending in the US versus China, the case for why the POS scaled to dominate the US and why mobile scaled to dominate in China is compelling.

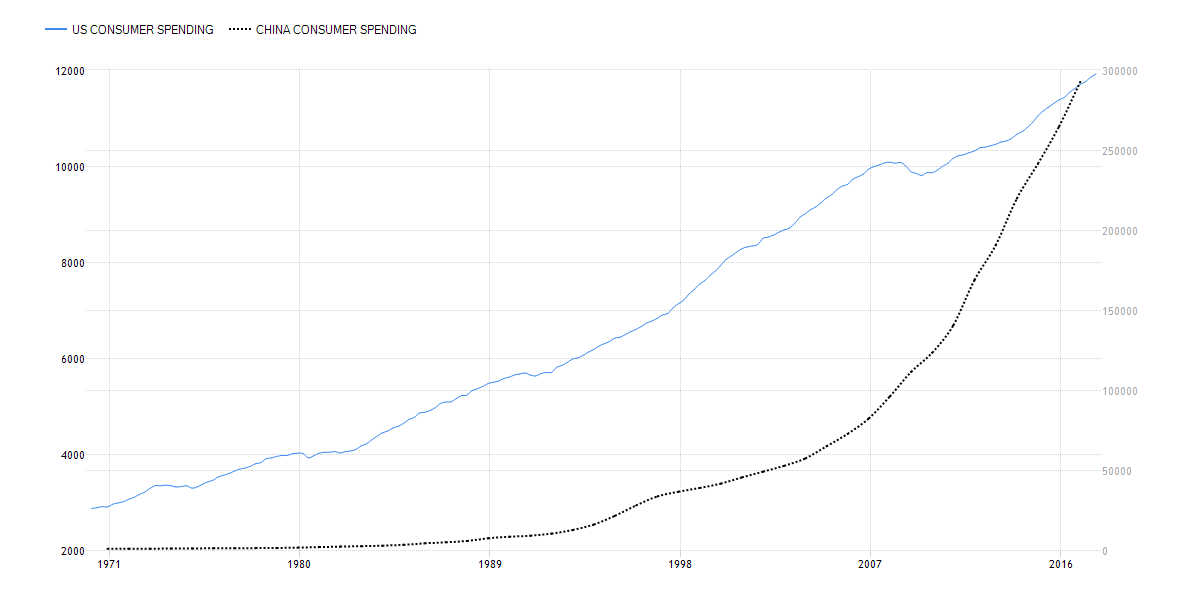

Source: TradingEconomics.com – United States Versus China Consumer Spending

As shown above, in the early 1970’s, consumer spending in the US started a steady upward climb. Compare this to China, where consumer spending was mainly flat until its inflection point, much later, in the mid 2000’s.3

As mentioned above, in 1973, the electronic POS entered the market in the US. The POS was the best-available payment tender technology at the time when consumer spending spiked.

In 2007, the iPhone entered the market and triggered the rapid proliferation and adoption of smartphones globally. Unlike the POS, by the end of the 2000’s while China’s market was experience explosive growth in consumer spending, mobile was the best-available payment tender technology in China.4

Disruption Ahead

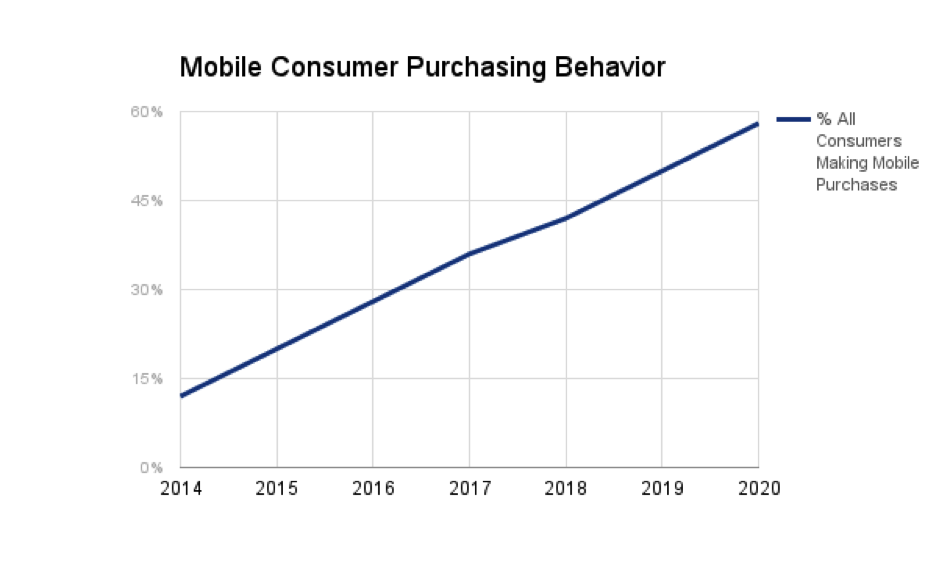

As described in an article I wrote for TotalRetail on mobile shopping behavior last year (early 2017), by the year 2020 nearly 60 percent of consumers in the US will be making purchases on mobile. That’s roughly an 8 percent increase every single year.

Additionally, recent Business Insider Analyst Reports provided separate forecasts which support the projections from my article in TotalRetail, stating that, “Our new estimate finds that US in-store mobile payment volume will reach $75 billion this year (2016). Between 2015-2020, we expect volume to rise by a compound annual growth rate (CAGR) of 80% to bring mobile payments volume to $503 billion by 2020. We forecast the number of in-store mobile payment users to rise at a 40% five-year CAGR to reach 150 million by the end of 2020. This represents 56% of the consumer population during that year.”5

Get Ready Now

Wondering what your company can do to prepare? Here’s a quick list:

- Start working on your mobile commerce products today.

- Making an investment in mobile is non-trivial. Consider capital expenditure budget requirements and ongoing operational expenditure requirements. You’ll need both.

- Plan for a steady, methodical transformation. Expect to crawl before you walk before you run. However get ready to run, as consumers are not slowing down.

- Adopting a new technology and consumer behavior is part IT and part Operations. Work on a plan for how to operationalize new consumer mobile commerce experiences and business workflows.

- Make sure you have your data. If you’ll need to change vendors, start building a data bridge today so you can centralize and own your data.

- Evaluate your merchant services, payment processing, POS and other site system agreements to see if there are any impediments to integration with mobile or adding mobile payments.

Summary

Transforming your business to mobile takes time, careful planning, meticulous execution, and ongoing innovation. The time to get started is now.

Standard Disclaimer: If I am proven wrong in any data or opinions provided herein, I will happily redact my statements and revise based on newly available information.

*^*^

- According to Wikipedia

- According to ChinaDaily

- According to TradingEconomics

- TotalRetail, Controlling Comparison Shopping by Embracing the Behavior

- Business Insider Analyst Reports